Do you want to calculate how much your current savings might be worth in 10 years or in 30 years? It’s an easy calculation that doesn’t require any specific function in Excel. Some simple multiplication, addition and exponentiation is all you need.

Still, the answer you will most likely get if you search for “compound interest in Excel” on Google is the FV function. The FV function is difficult to use, and it actually calculates compound interest based on a monthly rate rather than a yearly rate, which gives a slightly different result.

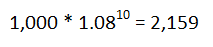

If you have $1,000, the yearly return is 8% and you let it compound for 10 years, you would calculate it like this:

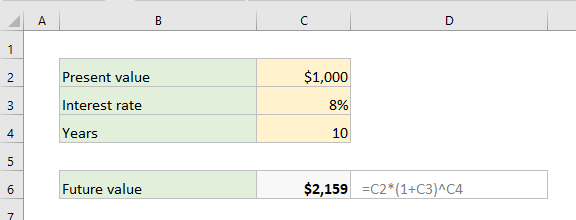

Of course, in Excel we don’t want to hardcode anything in the formula, so we’ll put the numbers in separate cells. This is how you can set it up:

Now you can change any of the variables in C2, C3 and C4, and the Future value will update instantly.

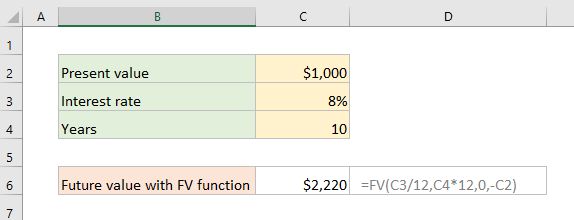

If you want to use the FV function instead, this is how it’s done. As mentioned above, the result is a little higher because it calculates the compound interest for every month.

More Excel tutorials:

How to find cells that contain a formula in Excel

How to Join Text from Several Cells in Excel using TEXTJOIN

5 Easy Steps to Make Your Excel Charts Look Professional

The Easiest Way to Hide Zeros in Excel

Are you using a non-English version of Excel? Click here for translations of the 140 most common functions in 17 different languages:

Catalan

Czech

Danish

Dutch

Finnish

French

Galician

German

Hungarian

Italian

Norwegian

Polish

Portuguese (Brazilian)

Portuguese (European)

Russian

Spanish

Swedish

Turkish